Mar 4, 2023 | Federal Criminal Law

Federal wire fraud, under 18 U.S.C. § 1343, is an allegation that fraud has been committed by using some kind of electronic communication. This type of electronic communication is construed broadly and can range from a fax, telephone, email, electronic messaging, use of electronic payment systems, and more. Common examples of wire fraud include internet “phishing” scams, operating a misleading website, or accepting electronic payment for a fraudulent transaction.

Because so much business is conducted using electronic communication, the wire fraud statute is commonly used by the government in the investigation and prosecution of economic or “white collar” criminal cases. For example, criminal investigations often begin with a wire fraud inquiry, and other, more specific, fraud charges (such as healthcare or tax fraud, etc.) are brought later on as a result of that investigation.

Elements of Wire Fraud

To establish wire fraud, the government must prove that the accused intentionally used some kind of electronic communication with the purpose of committing fraud. More specifically, the wire fraud statute, found in 18 U.S.C. § 1343, provides as follows:

Fraud by wire, radio, or television

Whoever, having devised or intending to devise any scheme or artifice to defraud, or for obtaining money or property by means of false or fraudulent pretenses, representations, or promises, transmits or causes to be transmitted by means of wire, radio, or television communication in interstate or foreign commerce, any writings, signs, signals, pictures, or sounds for the purpose of executing such scheme or artifice, shall be fined under this title or imprisoned not more than 20 years, or both. If the violation occurs in relation to, or involving any benefit authorized, transported, transmitted, transferred, disbursed, or paid in connection with, a presidentially declared major disaster or emergency (as those terms are defined in section 102 of the Robert T. Stafford Disaster Relief and Emergency Assistance Act (42 U.S.C. § 5122)), or affects a financial institution, such person shall be fined not more than $1,000,000 or imprisoned not more than 30 years, or both.(1)

Courts break down wire fraud into three elements, requiring that the defendant: “(1) devised or willfully participated in a scheme to defraud, (2) used an interstate wire communication in furtherance of the scheme, and (3) intended to deprive a victim of money or property.”(2) The deprivation of property must be an object of the scheme, not merely incidental to it.(3)

Typically, the element at issue in a wire fraud case is intent. The Sixth Circuit Court of Appeals recently addressed this element in United States v. Montgomery, explaining that “[d]irect evidence of fraud can be scarce, so a factfinder may consider circumstantial evidence of fraudulent intent and draw reasonable inferences therefrom.”(4) For example, fraudulent intent “can be inferred from efforts to conceal the unlawful activity, from misrepresentations, from proof of knowledge, and from profits.”(5)

The recent Montgomery case, currently on appeal to the United States Supreme Court, serves as an example of how fraudulent intent can be inferred. There, five defendants were charged and convicted with various counts of fraud, including wire fraud. The defendants were drug marketers that allegedly convinced friends and family to order prescription creams and wellness tablets that they did not need, and then pocketed a portion of the insurance reimbursement for themselves.

On appeal, the Sixth Circuit explained that the defendants’ intent to defraud could be inferred from the following evidence: the defendants targeted individuals who had insurance that would not scrutinize the prescriptions at issue; the defendants paid individuals to order the creams and pills; the defendants created pre-set order pads with drug formulas tailored to maximize their profit; they persuaded customers to order unneeded and unwanted creams; they ordered extra creams and refills for customers without their knowledge or consent; they paid medical providers to sign prescriptions without seeing patients; and they directed pharmacists to backdate prescriptions to ensure the drugs were covered by insurance. Such actions, explained the Sixth Circuit, “constitute[ed] an intentional, comprehensive scheme to defraud and establish the defendant’s guilt beyond a reasonable doubt.”(6)

Conspiracy to Commit Wire Fraud

It is also important to note that, if more than one person is involved in the alleged wire fraud, federal prosecutors will often bring conspiracy charges under U.S.C. § 371 and 18 U.S.C. §1349 as well. A conspiracy to commit wire fraud requires that two or more persons conspired, or agreed, to commit wire fraud and the defendant knowingly and voluntarily joined the conspiracy.(7)

In the Sixth Circuit, “the government is not required to allege all of the elements of the underlying substantive offense [e.g. wire fraud] when charging a conspiracy under § 371.”(8) Instead, the Sixth Circuit has held that, in the instance of a charge of conspiracy to commit fraud, “the government merely ha[s] to prove beyond a reasonable doubt that [the defendant] knowingly and voluntarily joined a conspiracy that intended to fraudulently obtain money and that a member of the conspiracy took at least one overt act in furtherance of the conspiracy.”(9)

Fraud Prosecution and Litigation Statistics

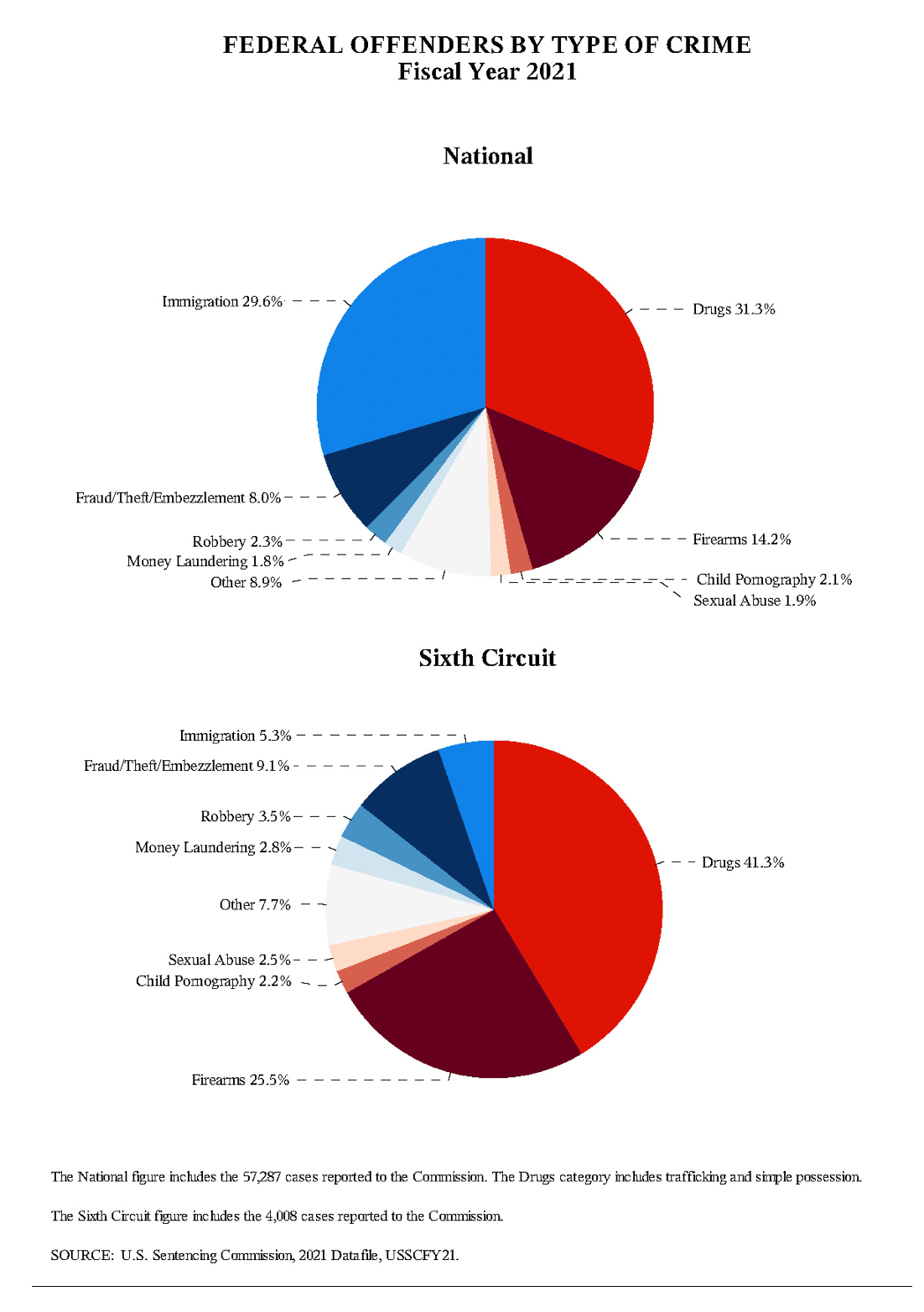

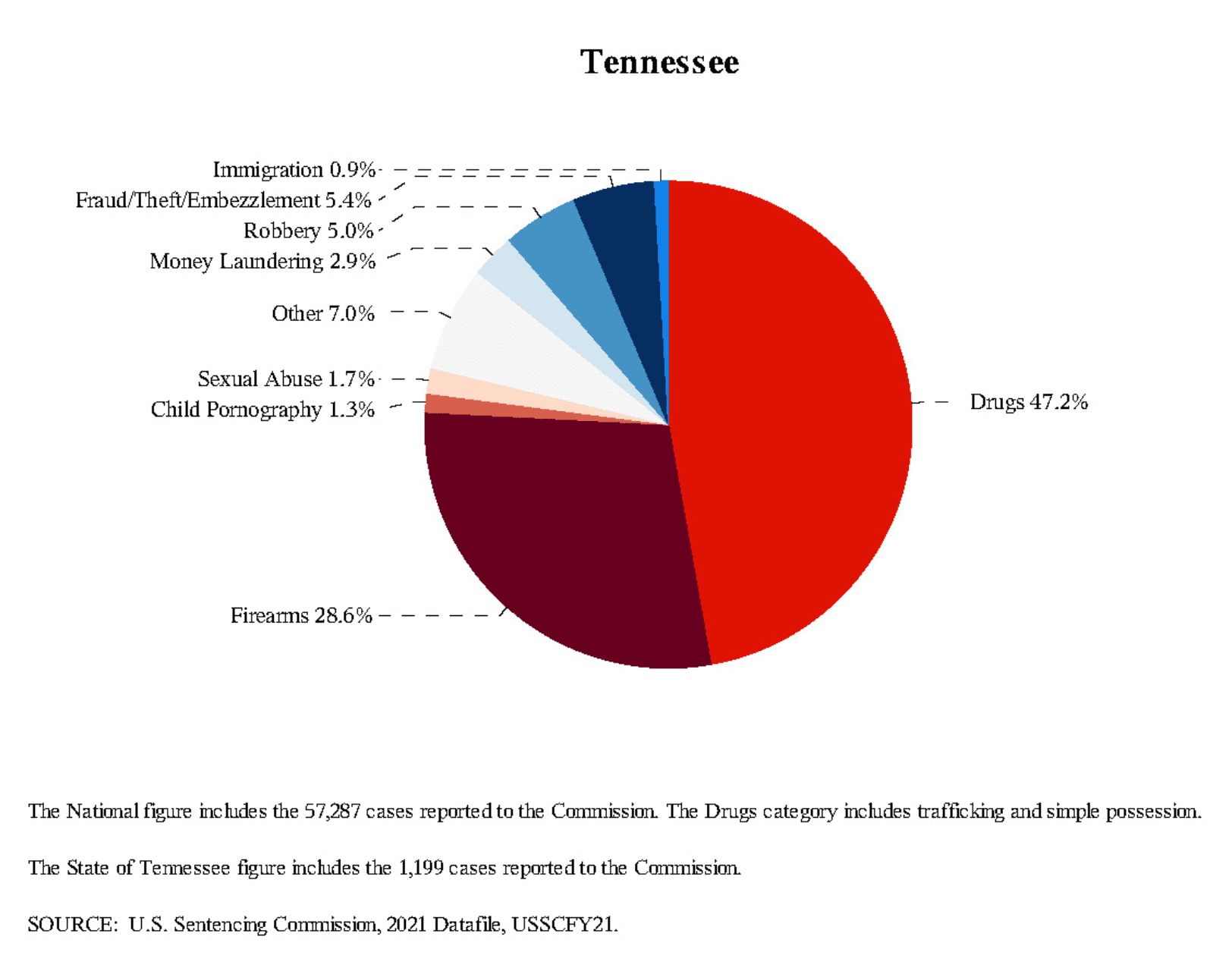

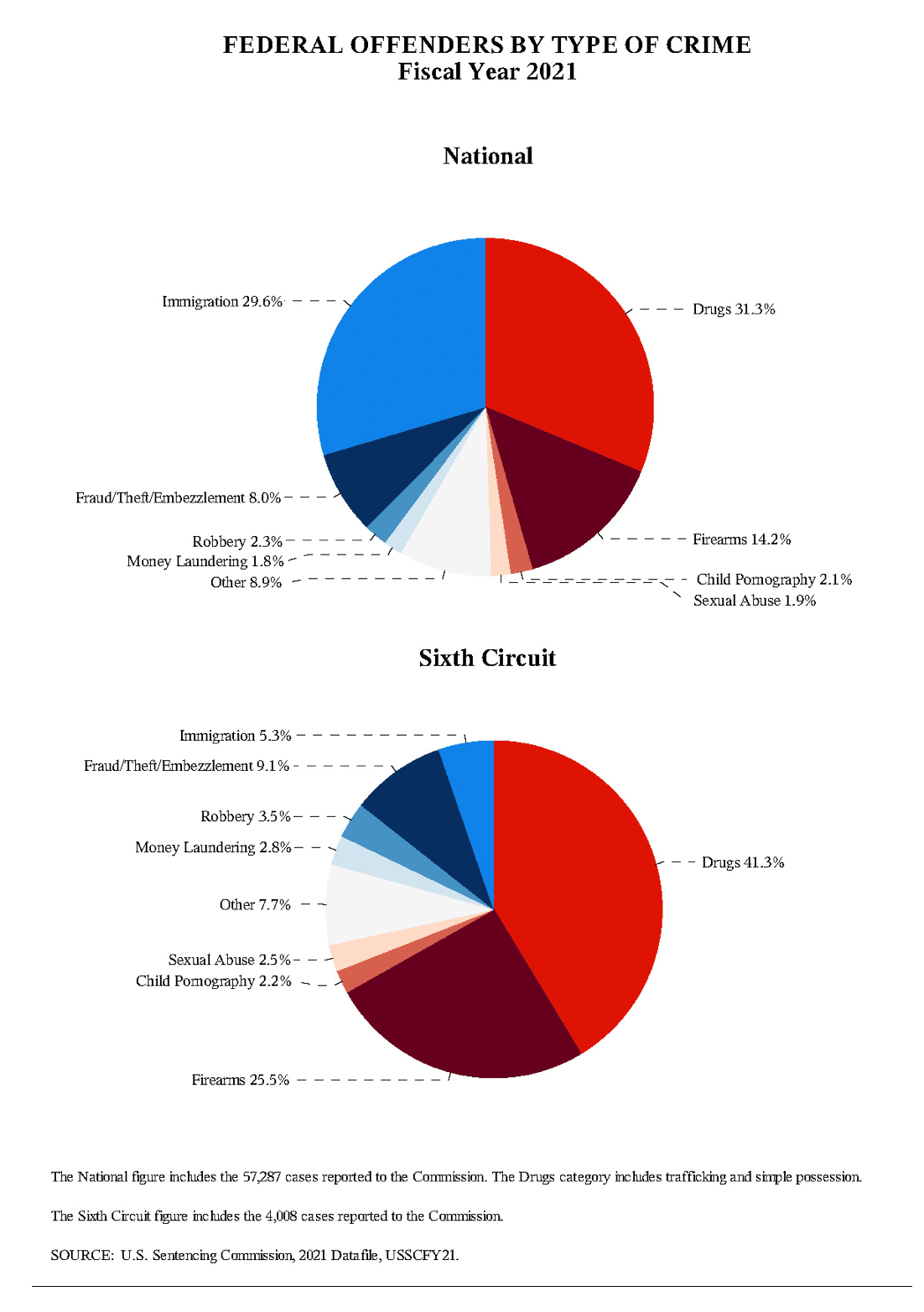

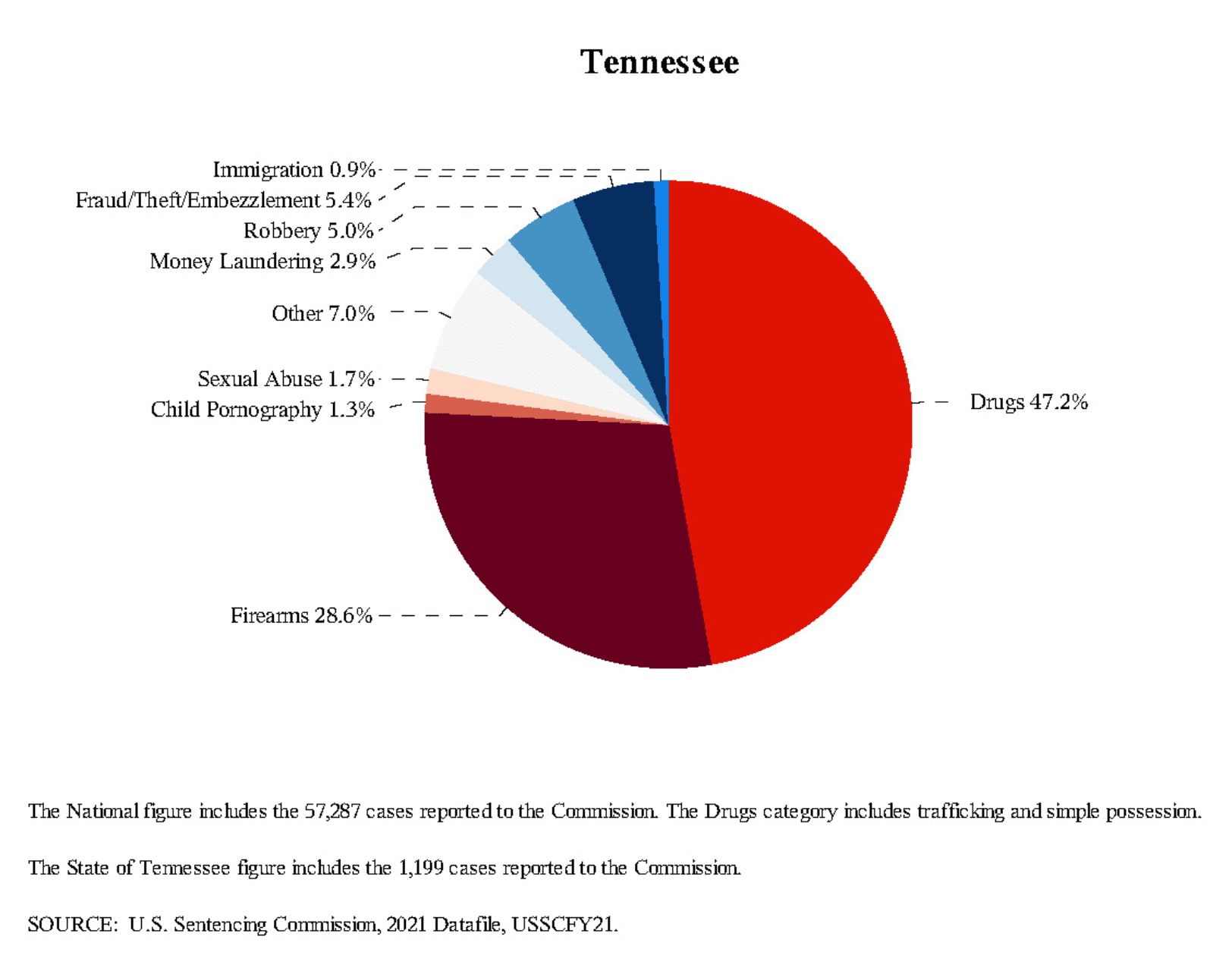

In the United States in 2021, fraud/theft/embezzlement cases amounted to 4,571 or 8% of federal crimes charged. In the Sixth Circuit, that figure is over 9%, with 365 cases that year.(10) In Tennessee, that is 65 or 5.4% of cases(11).

The large majority of these cases result in guilty pleas. As for the resolution of these cases in 2021, nationally 4,469 (or 97.8%) of these cases resulted in a plea of guilty, with 102 (2.2%) being tried. In the Sixth Circuit, 360 (or 98.6%) of these cases resulted in a plea of guilty, with 5 (1.4%) (12)being tried. In Tennessee, 64 (or 98.6%) resulted in a plea of guilty, with 1 (or 1.4%) being tried. (13)

Sentencing

A single act of wire fraud is punishable for up to 20 years in prison, a fine, or both. In certain situations, this felony is punishable for up to 30 years in prison, a fine, or both. Sentencing in wire fraud cases is highly dependent upon the facts of the case and the character and history of the accused.

As for sentencing data, nationally, individuals convicted of fraud/theft/embezzlement are given an average of 20 months. In the Sixth Circuit, individuals convicted of fraud/theft/embezzlement are sentenced to an average of 15 months.(14) In Tennessee, the average sentence is 21 months.(15)

The district courts arrive at these sentences by using the Federal Sentencing Guidelines. These guidelines are an advisory set of recommendations aimed at ensuring uniform sentencing. They provide a method for arriving at a range of months (called a “guideline range”) and then offer some recommendations for departing from this range in certain situations (increasing or decreasing the sentence). Most wire fraud charges fall under Federal Sentencing Guideline § 2B1.1. Generally, factors that can impact a defendant’s sentence under the wire fraud statute include (but are not limited to) the loss amount, the number of victims, any infliction of emotional harm, the defendant’s criminal history, any substantial assistance to authorities, and more.

As related to the guideline ranges, nationally, individuals convicted of fraud/theft/embezzlement are sentencing within the guideline range 42.9% of the time.

In the Sixth Circuit, individuals convicted of fraud/theft/embezzlement are sentenced within the guideline range 39.7% of the time.(16) In Tennessee, individuals are sentenced within the guidelines range 37.5% of the time. (17)Accordingly, the data shows that district judges are willing to issue sentences outside of the guideline ranges if presented with effective arguments at sentencing.

Conclusion

With decades of experience litigating “white collar” crimes and defending individuals charged with fraud, the legal team at Davis & Hoss is ready to help individuals facing potential allegations of wire fraud or those that simply have questions. Contact Attorney Lee Davis at lee@davis-hoss.com or by phone at 423-266-0605 for more information.

Reference:

- 18 U.S.C. § 1343

- United States v. Rogers, 769 F.3d 372, 377 (6th Cir. 2014).

- Kelly v. United States, 140 S. Ct. 1565, 1573 (2020).

- United States v. Montgomery, No. 20-5891, 2022 WL 2284387, at *9 (6th Cir. June 23, 2022) (citations, internal quotations, and punctuation omitted).

- Id. (citations, internal quotations, and punctuation omitted).

- Id.

- United States v. Palma, 58 F.4th 246, 249 (6th Cir. 2023) (citations, internal quotations and punctuation omitted).

- United States v. Henderson, No. 3:22-CR-14-TAV-JEM-1, 2022 WL 17061070, at *7 (E.D. Tenn. Nov. 17, 2022) (motion to dismiss denied).

- Id. (citing United States v. Washington, 715 F.3d 975, 980 (6th Cir. 2013)).

- United States Sentencing Commission Statistical Information Packet, Fiscal Year 2021, Sixth Circuit, Figure A, p. 1; Table 1 p. 3

https://www.ussc.gov/sites/default/files/pdf/research-and-publications/federal-sentencing-statistics/state-district-circuit/2021/6c21.pdf

- United States Sentencing Commission Statistical Information Packet, Fiscal Year 2021, State of Tennessee, Figure A, p. 1; Table 1, p.3

https://www.ussc.gov/sites/default/files/pdf/research-and-publications/federal-sentencing-statistics/state-district-circuit/2021/tn21.pdf

- United States Sentencing Commission Statistical Information Packet, Fiscal Year 2021, Sixth Circuit, Table 3, p. 7

https://www.ussc.gov/sites/default/files/pdf/research-and-publications/federal-sentencing-statistics/state-district-circuit/2021/6c21.pdf

- United States Sentencing Commission Statistical Information Packet, Fiscal Year 2021, State of Tennessee, Table 3, p.7

https://www.ussc.gov/sites/default/files/pdf/research-and-publications/federal-sentencing-statistics/state-district-circuit/2021/tn21.pdf

- United States Sentencing Commission Statistical Information Packet, Fiscal Year 2021, Sixth Circuit, Table 7, p. 11

https://www.ussc.gov/sites/default/files/pdf/research-and-publications/federal-sentencing-statistics/state-district-circuit/2021/6c21.pdf

- United States Sentencing Commission Statistical Information Packet, Fiscal Year 2021, State of Tennessee, Table 7, p. 11

https://www.ussc.gov/sites/default/files/pdf/research-and-publications/federal-sentencing-statistics/state-district-circuit/2021/tn21.pdf

- United States Sentencing Commission Statistical Information Packet, Fiscal Year 2021, Sixth Circuit, Table 10, p. 16

https://www.ussc.gov/sites/default/files/pdf/research-and-publications/federal-sentencing-statistics/state-district-circuit/2021/6c21.pdf

- United States Sentencing Commission Statistical Information Packet, Fiscal Year 2021, State of Tennessee, Table 10, p. 16

https://www.ussc.gov/sites/default/files/pdf/research-and-publications/federal-sentencing-statistics/state-district-circuit/2021/tn21.pdf

Feb 27, 2023 | Tennessee Criminal Legislation

Tennessee’s ban on abortion took effect August 25, 2022, two months after the Supreme Court’s landmark Dobbs v. Jackson Women’s Health Organization overturned federal protection for abortion. As of today, the state’s abortion law, codified in Tennessee Code Annotated § 39-15-213, is one of the strictest in the nation.

The law, drafted in 2019 to be triggered upon the overturning of Roe v. Wade, makes performing an abortion a felony and provides no exceptions for cases of incest or rape. It also places a difficult burden on healthcare providers by subjecting them to potential criminal prosecution. In response to concerns from the medical community and the community at large, some Republican and Democratic lawmakers are busy drafting amendments to the abortion ban.

Chilling Effect of Tennessee Abortion Ban on Healthcare Providers

As currently written, the Tennessee law does not offer any protections for healthcare providers in the context of life-saving abortions, but instead requires physicians to use as an “affirmative defense”—to prove that the abortion “was necessary to prevent the death of the pregnant woman or to prevent serious risk of substantial and irreversible impairment of a major bodily function of the pregnant woman.” The law provides that an abortion or attempted abortion is a Class C felony, punishable by up to 15 years in prison.

Accordingly, the current law places the burden of proof on healthcare providers and subjects them to arrest and criminal prosecution. Ashley Coffield, CEO of Planned Parenthood of Tennessee and North Mississippi, explained that the wording of this law “will make the doctor

1. Tenn. Code Ann. § 39-15-213 (2022).

second guess their medical training and expertise when choosing a treatment plan or risk a felony criminal conviction.”

Another medical professional, Nikki Zite, M.D., M.P.H., on the executive committee of the Tennessee section of the American College of Obstetricians and Gynecologists, expressed similar concerns. She explained that the trigger law might lead doctors to hesitate, to contact lawyers during medical emergencies, while their patients get sicker: “We are now at the mercy of the criminal justice system,” Zite said. “Should I win? I think so. But do I want to go through that? No. I don’t want to feel guilty until proven innocent.”

Similarly, Molly A. Meegan, the chief legal officer and general counsel of the American College of Obstetricians and Gynecologists, opposes any “criminal penalties, lawsuits, fines or other punishments for providing the full spectrum of evidence-based care.” She explained that doctors, who are already under an incredible amount of stress, are caught in the middle. “They are becoming a punching bag for legislators trying to make a political point.”

Proponents of the Tennessee Abortion Ban dismiss these concerns. Will Brewer, an attorney and lobbyist with Tennessee Right to Life, thinks doctors with such concerns are exaggerating the possible consequences. “I think you’re going to be hard-pressed to find a prosecutor that is going to prosecute a physician when they can back up their claim that they did

2. https://www.tennessean.com/story/news/health/2022/08/25/tennessee-abortion-ban-what-to-know-roe-v-wade/7886564001/

3. https://apnews.com/article/abortion-health-knoxville-statutes-government-and-politics-1a92f84003556cdd071f6297cd5f43c0

4. https://www.nytimes.com/2023/02/16/us/abortion-bills-doctors.html?smid=nytcore-ios-share&referringSource=articleShare

this to save the life of the mother,” Brewer said. On the other hand, Mr. Brewer is on record arguing that lawmakers chose the wording for a specific reason: to make it difficult for doctors to perform an abortion.

Tennessee already ranks toward the top of the list of states with high maternal mortality rates. The ultimate fear is that doctors will move out of the state of Tennessee to avoid dealing with the Abortion Ban. Providing some relief for physicians, the Interstate Medical Licensure Compact, which coordinates and streamlines the process by which physicians can be licensed in multiple states, changed its interstate compact rules in November due to increased concerns from doctors. Previously, under the Interstate Medical Licensure Compact, a physician whose license in one state was revoked or suspended would automatically face the same penalty for 90 days in the nearly 40 states that have joined the compact. But now if a physician is licensed in more than one state and one state takes away the physician’s license solely because of abortion, the other state does not have to follow that suspension order.

Proposed Amendments to the Tennessee Abortion Ban

Governor Lee and other top Republican lawmakers have spent months defending the current law, arguing that pregnant women are protected from harm and doctors are unlikely to

5. https://apnews.com/article/abortion-health-knoxville-statutes-government-and-politics-1a92f84003556cdd071f6297cd5f43c0

6. https://apnews.com/article/abortion-health-knoxville-statutes-government-and-politics-1a92f84003556cdd071f6297cd5f43c0

7. https://www.nytimes.com/2023/02/16/us/abortion-bills-doctors.html?smid=nytcore-ios-share&referringSource=articleShare

face any felony charges outlined in the statute. However, groups of Republican and Democratic lawmakers facing public pressure have begun pushing for amendments.

- Removing the Affirmative Defense and Clarifying Situations in Which Abortion is Allowed

Most recently, on February 14, 2023, Tennessee legislators advanced a bill that removes the “affirmative defense” element for medical providers and clarifies situations in which abortion is allowed. This bill explicitly states that “criminal abortion … does not include a termination of pregnancy of a woman known to be pregnant that is performed by a physician to (i) remove a medically futile pregnancy; (ii) remove an ectopic or molar pregnancy; (iii) dispose of an unimplanted fertilized egg; (iv) address a lethal fetal anomaly; or (v) prevent or treat a medical emergency (while providing best opportunities for the fetus to survive).

The bill’s sponsor, Representative Esther Helton-Haynes, R-East Ridge, stated that “[t]his bill clarifies what I believe was the original intent of (the law), which is to ban elective abortion in the state of Tennessee.”

Other representatives at the hearing voiced concerns that doctors could be afraid to do their jobs out of fear of being criminally prosecuted as the law is currently written. “We have to protect our doctors,” said Representative Sabi Kumar, R-Springfield, who is a surgeon. “So, they

8. Proposed Amendment No. 003797, 2023 Tennessee Senate Bill No. 745, Tennessee One Hundred Thirteenth General Assembly – First Regular Session, 2023 Tennessee House Bill No. 883, Tennessee One Hundred Thirteenth General Assembly – First Regular Session. See also https://capitol.tn.gov/Archives/Dashboard/HR%20Scanned%20Amendments/HB0883_Amendment%20003797.pdf

9. https://www.timesfreepress.com/news/2023/feb/14/tennessee-advances-bill-to-narrowly-loosen-abortion-ban/

feel they’re fulfilling the Hippocratic oath, doing God’s work, saving and preserving lives – that’s what physicians do.”

Mr. Brewer, with Tennessee Right to Life, was present at this hearing and threatened that there could be more consequences for those who support this amendment. “I would not consider this a pro-life law. And in discussions with our (political action committee), they have informed me that they would score this negatively,” he said. His remarks sparked condemnation from Democratic and Republican lawmakers and Speaker Sexton issued a firm rebuke as a result of Mr. Brewer’s threat.

Speaker Sexton has been one of the top Republicans to call for amendments to the law—for shifting the burden of proof to prosecutors rather than doctors and for exceptions for rape and incest. On the other end of the political spectrum, Democrats have supported the proposed changes, even if they would like for them to go further. At this point, the proposal has several hurdles to cross before reaching Governor Lee’s desk. And, in the Senate, Lieutenant Governor Randy McNally has said he does not believe the abortion ban needs changing but that he will not block any proposals from moving forward. Governor Lee has declined to say whether he will veto any amendments.

10. https://www.timesfreepress.com/news/2023/feb/14/tennessee-advances-bill-to-narrowly-loosen-abortion-ban/

11. https://www.timesfreepress.com/news/2023/feb/14/tennessee-advances-bill-to-narrowly-loosen-abortion-ban/

12. https://www.timesfreepress.com/news/2023/feb/14/tennessee-advances-bill-to-narrowly-loosen-abortion-ban/

Though the Helton-Haynes’ bill is the first to get a committee hearing (making the most progress), other bills to introduce exceptions into Tennessee’s abortion ban have also been filed. For example, another controversial piece of the legislation is that the Abortion Ban provides no exceptions in cases of rape or incest. One such pair of bills seeks to address that issue. Senate Bill 857 and House Bill 1440, sponsored by Sen. Ferrell Haile, R-Gallatin and Rep. Iris Rudder, R-Winchester, would legalize abortions for pregnancies that result from rape or incest under certain circumstances and with strict requirements.

This proposed exception would require that a licensed physician confirm that the pregnant woman reported the offense to the appropriate law enforcement agency, submit to a forensic medical exam (if appropriate and available), and ensure that a sample of the embryonic or fetal tissue extracted during the abortion will be preserved and available to be turned over to the Tennessee Bureau of Investigation for use in the investigation of the offense. Importantly, this exception would only apply during the first trimester: for women less than 8-10 weeks pregnant depending on their age.

The bill also includes significant criminal penalties for “false” reporting of sexual assault to obtain an abortion, which has sparked some criticism over the potential chilling effects for sexual assault survivors. Specifically, a defendant “must be sentenced to a mandatory minimum

13. 2023 Tennessee Senate Bill No. 857, Tennessee One Hundred Thirteenth General Assembly – First Regular Session, 2023 Tennessee House Bill No. 1440, Tennessee One Hundred Thirteenth General Assembly – First Regular Session. See also https://www.capitol.tn.gov/Bills/113/Bill/SB0857.pdf

14. https://www.tennessean.com/story/news/politics/2023/02/14/tennessee-abortion-ban-republicans-press-state-right-to-life/69903309007/

sentence of at least three (3) years in incarceration, and the person must serve one hundred percent (100%) of the three-year sentence.”

On February 6, 2023, Senate Bill 857 was passed on second consideration and referred to the Senate Judiciary Committee. A day later, House Bill 1440 was passed on second consideration and assigned to the Population Health Subcommittee.

- Clarifying that Contraception is Not Abortion

Tennessee’s Abortion Ban does not explicitly mention contraception, though confusion has caused public concern that emergency birth control like Plan B would be outlawed. Plan B and other “morning after” contraception are not abortion pills. Rather, they prevent a woman’s egg from fully developing and prevent eggs from attaching to the wall of the uterus.

Some have expressed concern that certain long-acting forms of contraception, such as intrauterine devices (IUDs) may be affected by the law as well. IUDs are T-shaped devices implanted in the uterus to prevent sperm from fertilizing eggs. Ashley Coffield, of Planned Parenthood, notes that IUDs do not trigger abortions. Though she added: “But, it’s about the enforcement of this law and how it’s interpreted. How it’s put into effect in Tennessee is left to be seen.”

15. 2023 Tennessee Senate Bill No. 857, Tennessee One Hundred Thirteenth General Assembly – First Regular Session, 2023 Tennessee House Bill No. 1440, Tennessee One Hundred Thirteenth General Assembly – First Regular Session. See also https://www.capitol.tn.gov/Bills/113/Bill/SB0857.pdf

16. https://www.tennessean.com/story/news/health/2022/08/25/tennessee-abortion-ban-what-to-know-roe-v-wade/7886564001/

17. https://www.tennessean.com/story/news/health/2022/08/25/tennessee-abortion-ban-what-to-know-roe-v-wade/7886564001/

In response to this concern about the ban’s effect on contraceptives, a set of companion bills, Senate Bill 885 and House Bill 1084 sponsored by Sen. Raumesh Akbari D-Memphis and Rep. Jessi Chism D-Memphis, clarify the definition of the word “abortion.” The language makes clear that “abortion does not include the use of contraceptives, including hormonal birth control, intrauterine devices, or emergency contraceptives.”

On February 6, 2023, Senate Bill 885 was passed and referred to the Senate Judiciary Committee. A day later, House Bill 1084 was passed and assigned to the Population Health Subcommittee.

Conclusion

With the Tennessee Abortion Ban being the strictest in the nation and undergoing rapid potential change, it is important to consult with experienced attorneys should you have a question or concern regarding this law. With decades of experience working with prosecutors, law enforcement, medical professionals, and the state legislature, the legal team at Davis & Hoss is ready to help individuals facing potential allegations under this law or those that simply have questions. Contact Attorney Lee Davis at lee@davis-hoss.com or by phone at 423-266-0605 for more information.

18. 2023 Tennessee Senate Bill No. 885, Tennessee One Hundred Thirteenth General Assembly – First Regular Session, 2023 Tennessee House Bill No. 1084, Tennessee One Hundred Thirteenth General Assembly – First Regular Session.

Feb 26, 2023 | Federal Criminal Law

CARES Act Fraud Investigation & Prosecution

The Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) is a federal law that was passed by Congress in the spring of 2020 in response to the COVID-19 pandemic. The CARES Act was designed to provide emergency financial assistance to Americans suffering economic hardship as a result of the pandemic. The relief programs created under the CARES Act were aimed to assist businesses quickly—the loan application processes were simple and little oversight was involved. Currently, the federal government is busy scrutinizing the CARES Act program for potential fraud and prosecuting both individuals and financial institutions. This article provides an update into CARES Act fraud investigations and prosecution.

Background: CARES Act Programs

- Payroll Protection Program (“PPP”)

One major form of relief provided by the CARES Act was the Payroll Protection Program (“PPP”). The PPP authorized potentially forgivable loans to small businesses for payroll and certain non-payroll costs (interest on mortgages, rent, and utilities, for example). The purpose of the loans issued under the PPP was to allow small businesses suffering from economic losses due to the pandemic to continue to pay salaries or wages to their employees. The proceeds of a PPP loan were not to be used to purchase consumer goods, personal investments, or to fund the borrower’s ordinary living expenses unrelated to the specified authorized expenses.

In the early days of the pandemic, the PPP was created quickly to prevent businesses from collapsing. Accordingly, the program’s loan application was simple and not highly scrutinized. The PPP was administered by the Small Business Administration (“SBA”). Eligible businesses seeking relief under the PPP could apply for assistance through a federal insured depository institution. The PPP loan application required the business (through an authorized representative) to acknowledge the program rules and state its average monthly payroll expenses, number of employees, and provide some documentation.

If the PPP loan application was approved, the participating lender funded the PPP loan using its own monies, guaranteed by the SBA. Data from the loan application was then transmitted to the SBA. The PPP allowed the interest and principal on the loan to be forgiven if the business spent the loan appropriately within a designated period of time and used a certain amount on payroll.

- Economic Injury Disaster Loan (“EIDL”)

The Economic Injury Disaster Loan (“EIDL”) program is an SBA program that provides low-interest, fixed-rate, long-term loans to small businesses, renters and homeowners in regions affected by national disasters. The CARES Act also authorized the SBA to provide EIDL’s of up to $2 million to eligible small businesses to help overcome the effects of the pandemic by providing working capital to meet operating expenses. The CARES Act authorized the SBA to issue advances of up to $10,000 to small businesses within three days of applying for an EIDL.

To apply for an EIDL under the CARES Act, a business was required to submit an application to the SBA and provide information about its operations, to include its number of employees, revenue for 12-month period prior to the disaster, and the cost of goods sold for 12-month period prior to disaster. To be eligible for an EIDL, the business must have been in

1. https://www.sba.gov/funding-programs/loans/covid-19-relief-options/paycheck-protection-program

operation before February 1, 2020. Applicants for EIDL loans were required to certify that the information in the application was true and correct to the best of their knowledge.

EIDL loans were submitted directly to the SBA and processed by the agency with support from a government contractor. Upon approval, the SBA disbursed the funds. EIDL loans were permitted to be used for operating expenses (including payroll), utilities, sick leave, production costs, and business obligations, such as debts, rent, and mortgage payments.

CARES Act Fraud

Through the PPP and the EIDL, the Small Business Administration has made or guaranteed about 18.7 million loans and grants. This has provided about $968 billion to small businesses affected by COVID-19. The SBA streamlined and simplified the programs to speed distribution. Ultimately, this resulted in less oversight and left the programs more susceptible to fraud.

With regard to the PPP specifically, it is estimated that over 8.5 million employers applied for and received PPP loans to cover payroll and certain nonpayroll costs during the pandemic. The Office of the Inspector General (OIG) reported in May that more than 70,000 loans totaling over $4.6 billion were potentially fraudulent. The OIG reported that the SBA lacked the necessary structure to prevent and detect PPP fraud. Also, the OIG reported that the SBA did not provide sufficient guidance to lenders to combat PPP fraud. During this review, the

2. https://www.sba.gov/funding-programs/loans/covid-19-relief-options/covid-19-economic-injury-disaster-loan/about-covid-19-eidl

3. https://www.gao.gov/products/gao-21-498t

4. https://tax.thomsonreuters.com/news/10-year-statute-of-limitations-established-for-paycheck-protection-program-loan-fraud/

OIG created the Fraud Risk Management Board to coordinate fraud risk prevention and response.

Fraud Investigation & Prosecution – Updates

- Federal Investigation & Prosecution of CARES Act Fraud is Growing

As of April 2022, Justice Department Inspector General Michael Horowitz, who chairs the Pandemic Response Accountability Committee, estimated that the Justice Department has issued over 1200 indictments, 900 arrests and 500 convictions. These efforts have resulted in criminal charges against over 1,000 defendants with alleged losses exceeding $1.1 billion and over 240 civil investigations into more than 1,800 individuals and entities for alleged misconduct in connection with pandemic relief loans totaling more than $6 billion. As of January 2023, the United States Justice Department has recovered $1.2 million of the stolen funds.

- New Ten-Year Statute of Limitations for CARES Act Fraud

Recently, President Biden signed the PPP and Bank Fraud Enforcement and Harmonization Act of 2022 [HR7352] that establishes a ten-year statute of limitations for criminal charges and civil enforcement against borrowers who engage in PPP fraud. Bank-related fraud generally has a statute of limitations of ten years, but multiple reports have indicated that

5. https://tax.thomsonreuters.com/news/10-year-statute-of-limitations-established-for-paycheck-protection-program-loan-fraud/

6. https://www.npr.org/2022/04/10/1091927667/money-from-the-covid-paycheck-protection-program-was-allegedly-largely-misspent

7. https://www.justice.gov/criminal-fraud/cares-act-fraud

8. https://www.ajc.com/news/crime/feds-atlanta-man-recruited-business-owners-to-commit-3-million-ppp-fraud/73EBLV2KBJGUJMQBJ23IU2SS5I/

financial technology (fintech) companies (discussed below) and their lending partners handled a majority of the loans connected to fraud by the DOJ. And, fintech original loan fraud has a five-year statute of limitations. The bill’s sponsor, Congresswoman Nyida M. Velazquez (D-NY-7), explained that the ten-year statute of limitations was needed to clear up this discrepancy and allow ample time to prosecute.

- Financial Tech – Fintech – Federal Investigations Ongoing

Financial Tech or “Fintech” companies were formed to assist people in obtaining CARES Act loans and collected a large amount of fees to do so. A recent report from the House Select Committee on the Coronavirus Crisis revealed that some non-bank fintech companies exploited gaps in CARES Act oversight. According to this committee, fintech lenders processed 15% of PPP loans, but were associated with 75% of loans suspected of fraud. Some fintech leaders allegedly approved loans in “as little as an hour,” often with little or no human review.

The congressional report is especially critical of two companies, Womply and Blueacorn. Both companies set up systems to help lenders process applications at a huge scale. For their work, Womply collected fees exceeding $2 billion and Blueacorn took in fees in excess of $1 billion.

In addition to lax internal oversight, Blueacorn gave priority (and less scrutiny) to high-dollar loans which generated larger fees for the company and its partners. So, in addition to enabling others to engage in PPP fraud, some company insiders received PPP loans for varieties of companies they owned themselves. Federal investigations into these companies are pending.

9. https://tax.thomsonreuters.com/news/10-year-statute-of-limitations-established-for-paycheck-protection-program-loan-fraud/

10. https://news.bloomberglaw.com/us-law-week/false-claims-act-action-starts-against-ppp-lenders

The recent congressional report includes specific recommendations for various governmental bodies to better safeguard future aid programs and urges the SBA to analyze the role of non-bank companies like fintechs (which face fewer regulatory constraints than banks) in its lending programs. The SBA inspector general’s office wrote in a statement: “A balance between speed and internal controls is achievable and necessary to ensure timely governmental assistance to disaster victims. The report shines light on a significant aspect of the emerging fraud landscape in the P.P.P., which is an O.I.G. oversight priority.”

One person facing current charges related to fintech PPP fraud is Rafael Martinez, CEO of MBE Capital Partners. Prosecutors claim that Martinez falsified documents by inflating his number of employees and payroll to secure a PPP loan of $280,000. Prosecutors also claim that Martinez used those falsified documents to become a PPP lender in April 2020. Like other fintechs in the news, MBE’s processing fees were high – MBE earned about $71 million in fees from originating $823 million in PPP loans to roughly 36,000 businesses. Federal prosecutors have charged Martinez with bank and wire fraud and with making false statements to a bank.

- Banks/Conventional Lenders—Settlements & Fines

More conventional lenders are also facing scrutiny over their processing of PPP loans. As the number of investigations into PPP fraud grows, penalties are beginning to be levied against banks as well.

- Prosperity Bank – False Claims Act Settlement

For example, Houston-based Prosperity Bank reached a False Claims Act settlement with federal prosecutors in September of 2022. This was the first Department of Justice settlement of

11. https://www.americanbanker.com/list/rooting-out-wrongdoing-in-ppp-loans

12. https://www.americanbanker.com/list/rooting-out-wrongdoing-in-ppp-loans

its kind with a PPP lender. The Prosperity Bank settlement reveals that PPP lenders can face FCA liability for borrower fraud.

This FCA settlement has alarmed the banking industry as guidance from the SBA had permitted PPP lenders to rely on borrowers’ certifications (to encourage lenders to participate while also allowing for quick and simple access to loans). More specifically, in an interim final rule issued in April 2020, the SBA allowed “lenders to rely on specified documents provided by the borrower to determine the qualifying loan amount and eligibility for loan forgiveness.” So long as lenders gathered required information from borrowers, they would be “held harmless for borrowers’ failure to comply with program criteria.”

In the Prosperity Bank case, Prosperity Bank approved a $213,400 PPP loan to Woodlands Pain Institute. That business’s owner falsely certified that he was not facing criminal charges, which would have made his business ineligible for the loan. Although Prosperity Bank seemingly could rely on that certification under SBA’s interim final rule, the DOJ still pursued an FCA claim, alleging that “Prosperity Bank employees knew [the owner] was facing charges.” The parties then settled for $18,673, nearly double the 5% processing fee that Prosperity Bank received for the loan. The settlement indicates that DOJ will not always hold banks harmless for a borrower’s failure to comply with PPP requirements.

- Popular Bank – Federal Reserve Board Fine

13. https://www.americanbanker.com/news/lenders-face-uncertain-legal-risks-amid-ppp-fraud-investigations

14. https://news.bloomberglaw.com/us-law-week/false-claims-act-action-starts-against-ppp-lenders

15. https://news.bloomberglaw.com/us-law-week/false-claims-act-action-starts-against-ppp-lenders

On January 24, 2023, the Federal Reserve Board announced that it fined Popular Bank $2.3 million for processing six PPP loans despite having detected the loan applications contained indications of potential fraud and failing to report the potential fraud in a timely manner. The six loans totaled approximately $1.1 million. According to the Federal Reserve Board, Popular Bank was an SBA approved lender and was required to follow their anti-money laundering policies, but failed to do so in processing these six PPP loans.

- Tennessee Federal Criminal Investigation & Prosecution Update

As of January 2023, several CARES Act fraud cases have been working their way through Tennessee district courts. So far, ten defendants have been sentenced and three defendants have pled guilty and are awaiting sentencing. Most defendants sentenced for CARES Act fraud in Tennessee have received prison sentences. Though the facts of their cases differ dramatically, of the ten individuals sentenced in Tennessee so far, six have been given prison sentences – ranging from 18 to 57 months.

In other recent Tennessee developments, five current or former IRS employees were charged in Memphis in October of 2022. According to court documents, the defendants allegedly obtained funds under the PPP and EIDL by submitting false and fraudulent loan applications that collectively sought over $1 million. They then used the loan funds for purposes not authorized by the PPP or EIDL Program, but instead for cars, luxury goods, and personal travel, including trips to Las Vegas. These cases were brought as part of an interagency effort between the Treasury

16. https://www.federalreserve.gov/newsevents/pressreleases/enforcement20230124a.htm

17. https://www.arnoldporter.com/en/general/cares-act-fraud-tracker

Inspector General for Tax Administration (TIGTA) and the SBA-OIG to combat and prevent CARES Act fraud by federal employees.

Conclusion

To date, the federal government is busy scrutinizing CARES Act programs for potential fraud and prosecuting both individuals and financial institutions for alleged fraud. Though CARES Act loans were often easy to obtain, the defense of these cases is complicated. With decades of experience in white collar criminal defense, and federal criminal defense, the legal team at Davis & Hoss is ready to help both individuals and institutions with all manner of issues arising under the PPP and other CARES Act programs. Contact Attorney Lee Davis at lee@davis-hoss.com or by phone at 423-266-0605 for more information.

18. https://www.justice.gov/usao-wdtn/pr/five-current-or-former-irs-employees-charged-defrauding-federal-covid-19-relief

Feb 23, 2023 | DUI

This article provides an update regarding

driving under the influence (DUI) offenses in the State of Tennessee. As discussed below, there is a recent increase in DUI arrests in the state and several changes in this area of the law—many of which took effect in the summer of 2022.

Driving Under the Influence (DUI) Arrests Increase in Tennessee

Using data compiled from state law enforcement agencies, the Tennessee Bureau of Investigation (TBI) cites 18,757 DUI arrests in 2021, a 3.03% increase from 2020. Of the top ten counties for DUI arrests, nearby Bradley County was the 6th highest in the state. The county recorded 122 DUI arrests in 2021. Hamilton County was tied for 7th highest (along with Robertson County) with 115 DUI arrests in 2021. So far in 2023, Chattanooga police have also reported a spike in DUIs. More specifically, 65 instances of driving under the influence were reported to the Chattanooga Police Department in January of 2023, compared to 42 in the first month of 2022.

New Tennessee DUI Laws – effective 2022

- DUI Offenders Required to Pay Child Support if Child’s Parent or Guardian Killed in DUI Related Crash—Tenn. Code Ann. § 39-13-219

A new Tennessee law—Ethan, Hailey, and Bentley’s Law—went into effect in the summer of 2022 and requires a judge to order any person convicted of vehicular homicide by intoxication or aggravated vehicular homicide by intoxication to pay child support to any surviving children of the victims until the child has reached 18. Under this law, the court is tasked with determining an

- https://www.wjhl.com/news/crime/these-tn-counties-reported-the-most-dui-arrests/

- https://www.timesfreepress.com/news/2023/feb/01/chattanooga-police-report-reduced-theft-more-duis-tfp/

amount that is “reasonable and necessary for the maintenance of the victim’s child” after considering the following factors:

- The financial needs and resources of the child;

- The financial resources and needs of the surviving parent or guardian of the child, including the state if the child is in the custody of the Department of Children’s Services;

- The standard of living to which the child is accustomed;

- The physical and emotional condition of the child and the child’s educational needs;

- The child’s physical and legal custody arrangements; and

- The reasonable work-related child care expenses of the surviving parent or guardian.

Defendants who are incarcerated and unable to pay the required maintenance are given one year after their release from incarceration to begin payment. The law provides an exception for defendants where the surviving parent or guardian obtains a judgment in a civil suit. In those cases, such payments will not be ordered or will be offset by the amount of judgment awarded.

Modeled after a law presented in Missouri, Brentwood attorney Ben Rose drafted the Tennessee law after a Tennessee jury found 58-year-old Janet Hinds guilty of vehicular homicide by intoxication in connection with Chattanooga Police Department Officer Nicholas Galinger’s death.

Back in February of 2019, Officer Galinger was hit by a vehicle driven by Ms. Hinds while he was inspecting a manhole in Chattanooga. Officer Galinger was taken to a local hospital

3. Tenn. Code Ann. § 39-13-219 (2022).

and later died. Ms. Hinds left the scene. She was later sentenced to 11 years in prison. Her case is currently being appealed. Ms. Hinds is exempt from paying such restitutions to Officer Galinger’s children since the law was passed after her conviction.

“This law is a tool in the toolbox,” Rose stated. “It’s one aspect, or one additional option that we can use to get folks that have committed these types of crimes to essentially pay restitution to these children that may be destitute without any other compensation.”

Tennessee was the first state to pass such a law, and more than twenty-five states are considering doing the same. In Missouri, however, the law ultimately failed to pass due to concerns that many of those convicted would simply not have the funds to provide such support.

- Stricter Boating Under the Influence (BUI) Penalties for Repeat Offenders – Tenn. Code Ann. § 69-9-219

Under Nicholas’ law, penalties grew harsher for repeat Boating Under the Influence (BUI) offenders in 2022. The law specifies that a prior conviction for BUI must be treated the same as a prior conviction for DUI for purposes of determining punishment for a violation of DUI. With a second offense, a defendant could also lose their license for two years.

After this law went into effect, the Tennessee Wildlife Resources Agency (TWRA) stepped up patrol on waterways across the state. The TWRA stated that “if you are found to be

4. https://www.timesfreepress.com/news/2023/jan/05/tennessee-bill-tfp/

5. https://www.ksdk.com/article/news/local/as-seen-on-tv/more-than-20-states-considering-bentleys-law-dui/63-3dc547a9-ab0b-4ccc-8d4f-f01023071f33;

https://www.wvlt.tv/2023/01/05/new-tennessee-law-leaves-dui-offenders-hook-child-support/

6. Tenn. Code Ann. § 69-9-219 (2022).

impaired while boating in Tennessee waterways under the influence, you will be charged with BUI, arrested, and taken to jail.”

Nicholas’ Law had the support of the group Mothers Against Drunk Driving, which is lobbying for these changes in other states as well.

- Ignition Interlock Devices Likely Required for Those Charged with DUI and DUI-related crimes—Tenn. Code Ann. § 40-11-118(d)

Effective in July 2022, people charged with DUI, vehicular assault, aggravated vehicular assault, vehicular homicide involving the driver’s intoxication, or aggravated vehicular homicide—will likely be required to operate only a motor vehicle equipped with an ignition interlock device as a condition of bail.

Under this new law, unless the court determines the requirement would not be in the best interest of justice and public safety, the use of an ignition interlock device is a mandatory condition of bail for persons charged with the aforementioned offenses if the alleged offense involved the use of alcohol and one of the following circumstances apply:

- The offense resulted in a collision involving property damage;

- a minor was present in the vehicle at the time of the alleged offense;

- the defendant’s driver license has previously been suspended for a violation of the present law regarding breath and blood tests to determine alcohol or drug content of a motor vehicle operator’s blood; or

7. https://wreg.com/news/local/dont-drink-and-boat-officials-step-up-patrols-on-waterways-after-bui-law-goes-into-effect/

8. https://www.wkrn.com/news/tennessee-news/new-laws-targeting-duis-in-tennessee-go-into-effect-friday/

- the defendant has a prior conviction of reckless driving, reckless endangerment, DUI of an intoxicant, vehicular assault, aggravated vehicular assault, vehicular homicide involving the driver’s intoxication, or aggravated vehicular homicide.

The new law requires the defendant to submit proof of installation of the device to the district attorney general within 10 days of being released on bail. If the court does not require the defendant to install such a device, the court must include in its order written findings as to why the requirement would not be in the best interest of justice and public safety.

- Transparency in Sentencing – Tenn. Code Ann. § 40-35-210

The new Transparency in Sentencing for Victims Act requires courts to place on record the estimated number of years and months a defendants will actually serve in prison before becoming eligible for release.

The purpose of the bill is “to try to give victims a better understanding of what the sentence will be at the time of sentencing,” said Rep. Michael Curcio, R-Dickson, a co-sponsor of the bill sponsored by House Speaker Cameron Sexton. Rep. Mike Stewart, D-Nashville, wanted to clarify the bill would not impact the length of time of any sentence but simply requires the court to give an explanation of a sentence.

- Truth in Sentencing Act—Tenn. Code Ann. § 40-35-501

The legislation known as “Truth in Sentencing” was passed without the signature of Governor Lee, and it applies to the following offenses committed on or after July 1, 2022: attempted first-degree murder, second-degree murder, vehicular homicide, aggravated vehicular

9. https://wapp.capitol.tn.gov/apps/Billinfo/default.aspx?BillNumber=SB0882&ga=112

10. https://www.thecentersquare.com/tennessee/tennessee-house-passes-bill-to-create-more-sentencing-transparency-for-crime-victims/article_06cad976-a618-11ec-a22a-7f408d5ebc95.html

homicide, especially aggravated kidnapping, especially aggravated robbery, carjacking, and especially aggravated burglary.

This law provides that there will now be no release eligibility for these offenses, and the offender will have to serve 100% of the sentence imposed by the court “undiminished by any sentence reduction credits the person may be eligible to earn.” The earned credits “may be used for the purpose of increased privileges, reduced security classification, or any purpose other than the reduction of the sentence imposed by the court.”

In addition, other offenses such as voluntary manslaughter, vehicular homicide, reckless homicide, criminally negligent homicide, and other listed crimes will have no release eligibility or credit reduction beyond 15%.

Recent Tennessee DUI Cases

- State v. Daniels – face mask requirement did not violate defendant’s right to confront witnesses

In this case, the defendant was convicted of a DUI and several other offenses. At trial, the defendant was required to wear a mask and witnesses who testified were permitted to remove their masks and testify behind a plexiglass barrier. The defendant appealed, in part, on the ground that his right to confrontation was denied when he was made to wear a face mask during the jury trial.

In denying this claim, the Tennessee Court of Criminal Appeals noted that the right of confrontation “is not absolute and must occasionally give way to considerations of public policy and necessities of the case.” The Court reasoned that there was a strong public policy concern

11. Tenn. Code Ann. § 40-35-501(bb)(1)-(2) (2022).

12. Tenn. Code Ann. § 40-35-501(cc)(2022);

https://dui.tndagc.org/newsletters/DUI%20News%20-%20Issue%2079.pdf

underlying this requirement issued by the Tennessee Supreme Court and that federal courts have addressed this issue finding that “requiring participants at trial to wear a face mask due to the COVID-19 pandemic does not violate a criminal defendant’s constitutional rights.” Also, the court noted that every witness that testified against the defendant did so in his physical presence and only his nose and mouth were covered. Therefore, there was not enough evidence that this mask requirement prevented the witnesses from “perceiving [the defendant’s] presence.” Therefore, the trial court’s enforcing an order of the Tennessee Supreme Court did not violate the defendant’s right to confront witnesses.

- State v. Moore—blood draw for medical purposes not subject to the exclusionary rule

In State v. Moore, the Tennessee Criminal Court of Appeals held that blood obtained by a hospital for medical purposes was not the result of “state action,” thus not subject to the exclusionary rule. In this case, the defendant struck a vehicle, injuring two people. She was airlifted to a hospital once she was removed from her vehicle. Once at the hospital, she had her blood drawn as part of routine triage in the emergency room. The officer on the scene did not get a warrant for a blood draw but obtained the defendant’s medical records about a week after the crash. The blood test results indicated a BAC of .176%.

A jury convicted Ms. Moore of vehicular assault, DUI and reckless endangerment. On appeal, in part, Ms. Moore complained about the blood sample drawn by the hospital (without a warrant), being used against her in a criminal trial. The Court of Criminal Appeals found no issue with the use of the blood draw. In affirming the trial court, the court of appeals held that

13. State v. Daniels, 656 S.W.3d 378, 387-88 (Tenn. Crim. App. June 29, 2022).

blood samples obtained for medical purposes are not taken as a result of state action and therefore, are not subject to the exclusionary rule.

- State v. Crass—officer’s failure to activate video not Ferguson violation

In State v. Crass, the defendant was indicted with DUI, DUI per se, and possession of a firearm while under the influence. The defendant moved to suppress the evidence, arguing, in part, that the video evidence of the defendant’s driving was deleted as a result of a malfunctioning recording system in the state trooper’s car. At the suppression hearing, the trooper testified that he thought he began recording the stop by pressing a button on his belt, but ultimately the camera did not activate and continued deleting the rolling video. The trial court granted the motion to suppress and dismissed the indictment, concluding that the loss of video evidence constituted a violation of the State’s duty to preserve potentially exculpatory evidence recognized in State v. Ferguson.

However, the Court of Criminal Appeals reversed, finding that the trial court misapplied Ferguson factors. The Court of Criminal Appeals held instead that the video of the pursuit was never captured and saved. Therefore, the video was not lost or destroyed by the State. The Court of Criminal Appeals reinstated the indictment.

- State v. Crowson – corrupted video not Ferguson violation

State v. Crowson also involves an issue with a police video. In State v. Crowson, the defendant was pulled over while driving a stolen vehicle. After a bench trial, he was convicted of

14. State v. Moore, 2022 WL 1086677 (Tenn. Crim. App. April 12, 2022).

15. State v. Ferguson, 2 S.W.3d 912, 915 (Tenn. 1999).

16. State v. Crass, 2022 WL 17102441 (Tenn. Crim. App. Nov. 22, 2022).

DUI 2nd offense, driving with a suspended license, possession of a weapon while under the influence, and felon in possession of a firearm.

Mr. Crowson filed, among other things, a motion to dismiss under Ferguson, because the officer’s dashboard video from the pursuit, before the traffic stop, had been deleted. At the hearing, police testified that when the video was initially saved to the server, it was “broken up into three different sections,” based on the size of the media file. Two of the video files were corrupted and could not be recovered.

On appeal, the Tennessee Criminal Court of Appeals determined that the State had a duty to preserve the dashcam video and they took the necessary steps to do so, but due to reasons beyond the State’s control, portions of the video were corrupted. Based on the facts, the Criminal Court of Appeals held that the defendant was not entitled to relief because he failed to show the State failed in its duty to preserve the video, failed to demonstrate negligence on behalf of the State, and failed to adequately explain the significance of the lost video.

Conclusion

With the increasing numbers of DUI arrests and the ever-changing law in this area, it is important to consult with experienced attorneys. With decades of experience defending DUI charges in Tennessee and Georgia, the legal team at Davis & Hoss is ready to help individuals facing these allegations. Contact Attorney Lee Davis at lee@davis-hoss.com or by phone at 423-266-0605 for more information.

17. State v. Crowson, 2022 WL 1714941 (Tenn. Crim. App. May 27, 2022).

FAQs Driving Under The Influence

If I get caught for a first time DUI what's the step I should take?

Your first move should be to reach out to a Chattanooga criminal defense lawyer who specializes in handling DUI cases. Meeting with them allows you to discuss the details of your arrest while they can devise a defense plan for you.

How crucial is it to select the defense lawyer?

It’s essential to choose a Chattanooga criminal defense attorney. A seasoned attorney can navigate you through the intricacies safeguard your rights and shield you from consequences.

What kind of actions might my lawyer recommend?

Your lawyer may suggest participating in a DUI education program or seeking substance abuse counseling as measures to demonstrate your commitment, towards resolving the issue. These actions can bolster your defense strategy.

What do recent statistics reveal about DUI arrests in Tennessee?

Data from the Tennessee Bureau of Investigation (TBI) indicates there were 18,757 DUI arrests in 2021 marking a 3.03% uptick from the year. Furthermore the Chattanooga Police Department noted an increase in DUI incidents, in January 2023 compared to January 2022 with 65 cases recorded versus 42 previously.

Can you tell me about the changes, in child support laws for DUI offenders?

The new Ethan, Hailey and Bentleys Law mandates that individuals found guilty of homicide by intoxication or aggravated homicide by intoxication must provide child support to the surviving children of the victims until they reach 18. This law takes into account factors such as the needs of the child and the available resources of the surviving parent.

How have penalties evolved for individuals charged with Boating Under the Influence (BUI)?

With Nicholas Law coming into effect there have been increased penalties for repeat BUI offenders starting in 2022. A previous BUI conviction now carries weight to a DUI conviction when determining sentencing. Following an offense a defendant could face a two year suspension of their license.

What are the regulations concerning ignition interlock devices?

Starting from July 2022 individuals facing charges related to DUI, assault, aggravated vehicular assault, vehicular homicide involving intoxication or aggravated vehicular homicide may be required to use vehicles equipped with an ignition interlock device while on bail. Exceptions may apply if deemed necessary for justice and public safety reasons, by the court.

What is the requirement of the Transparency, in Sentencing for Victims Act?

This act mandates that courts must verbally disclose the duration a defendant is expected to serve in prison before being considered for release aiming to provide victims with an insight into the sentencing.

In what manner did the Truth in Sentencing Act impact sentencing for crimes?

The Truth in Sentencing Act stipulates that certain serious offenses such as attempted first degree murder, second degree murder and vehicular homicide committed after July 1 2022 entail no possibility of release necessitating offenders to complete their entire sentence. Moreover there are restrictions on reducing sentences beyond a 15% credit allowance, for offenses.